Several weeks ago CJ Hutsenpiller pulled back the curtains on his contest strategy in a tweet thread. And all I can say is it was damn near criminal how little interaction that thread got.

After reaching out to CJ and getting his okay, I wanted to make that the focus this week of the newsletter. And as a bonus if you read all the way to the end I built a contest ROI calculator so you can run your numbers to see if it would be profitable for you to add contests to your marketing repertoire.

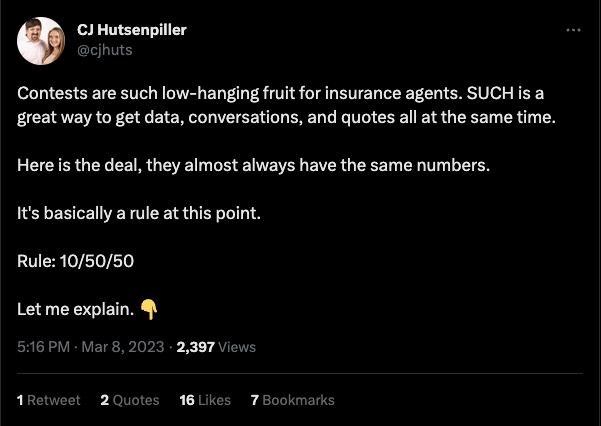

Contests are a hidden gem in the arsenal of marketing strategies for insurance agents. Not only do they generate buzz and engagement, they can also bring a goldmine of leads, opportunities for conversations, and quotes in one swoop. According to my friend CJ Hutsenpiller there’s an almost algorithmic efficiency to contests, a rule of thumb he calls the 10/50/50 rule.

Understanding the 10/50/50 Rule: A Closer Look

So, what is this rule, you may ask? Here’s the breakdown:

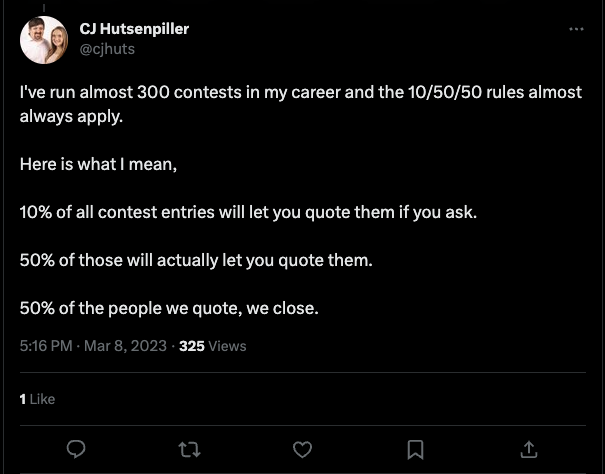

- 10% of all contest entries will let you quote them if you ask.

- 50% of those will actually let you follow through with the quote.

- 50% of the people we quote, we close.

Let’s do the math on this. Suppose your insurance agency runs a contest with a desirable prize, say, a YETI 45 cooler worth $325. The contest rakes in 723 entries. Applying the 10/50/50 rule, we can anticipate about 72 quote requests from the total entries. Half of these, or about 36, will go through the actual quotation process. Finally, about 18 will lead to closed deals.

Assuming an average account size of $375 in revenue, this translates to $6,425 in returns from a contest that required a $325 investment. And these figures are conservative; some contests may yield even better results.

Financial Returns and Beyond: Growing Your Email List

Yet, the benefits of contests extend beyond immediate new premium. They also help grow your email list. In our example, even those who didn’t request a quote (around 630 people) can be valuable contacts for future campaigns. While they may not be interested right now, they’re potential customers in the making. Their information can be saved and used for gentle, non-invasive follow-up efforts, like newsletters, more contest entries, or holiday cards.

Imagine running a similar contest every month for a year. With each new contest, you could be generating over $100k in revenue annually and growing your database by thousands. This doesn’t mean contests should be your only marketing strategy, but it’s hard to ignore the potential benefits that this relatively low-effort tactic can provide.

An important point to consider is compliance. In the world of insurance, staying compliant with local and state laws is crucial.

With contests, it’s a two-step process: the contest generates the data, and the agent turns it into a lead. Once an entry comes in, the agent initiates a phone call to confirm the entry and, in the process, casually brings up the insurance angle.

The best part is you already have the tools to run contests. Everyone has a form tool. CJ uses Jotform, I prefer Gravity Forms, but whatever floats your boat.

From Contest Entry to Insurance Conversation: A Smooth Transition

Adding contests into your marketing strategy could be a game-changer for your insurance agency. Not only do they generate leads and provide immediate financial returns, but they also contribute to long-term business growth by adding potential clients to your database. The initial prize investment can potentially yield significant returns and foster a robust, continually growing pool of prospective clients.

Example phone script I slapped together

Hey John, this is Nick with FAFO Insurance, just confirming you’re a real entry for the Yeti cooler, you’re a real person right? Cool chuckle. Hey John while I’ve got you on the phone think we could take a few minutes get some basic information and put together an insurance quote that might save you a few bucks?

This isn’t my strategy, I’m helping one agent implement it, but I just think it’s one of those things that if an agency is looking to do cool stuff in their community and is tired of buying leads, this is a great alternative.