TL;DR

- Insurance buyers hit 20–50 touchpoints before they even take action, not just before they buy.

- Most agents only show up in 2–3 of those moments, making them invisible for most of the journey.

- Complex policies like trucking or workers’ comp require even more interactions to build trust.

- Consistent, helpful content across a few key channels multiplies your visibility without burning you out.

The Invisible Load Before the Click

The average insurance customer experiences 20 to 50 touchpoints before they even take a serious action, not just before they buy.

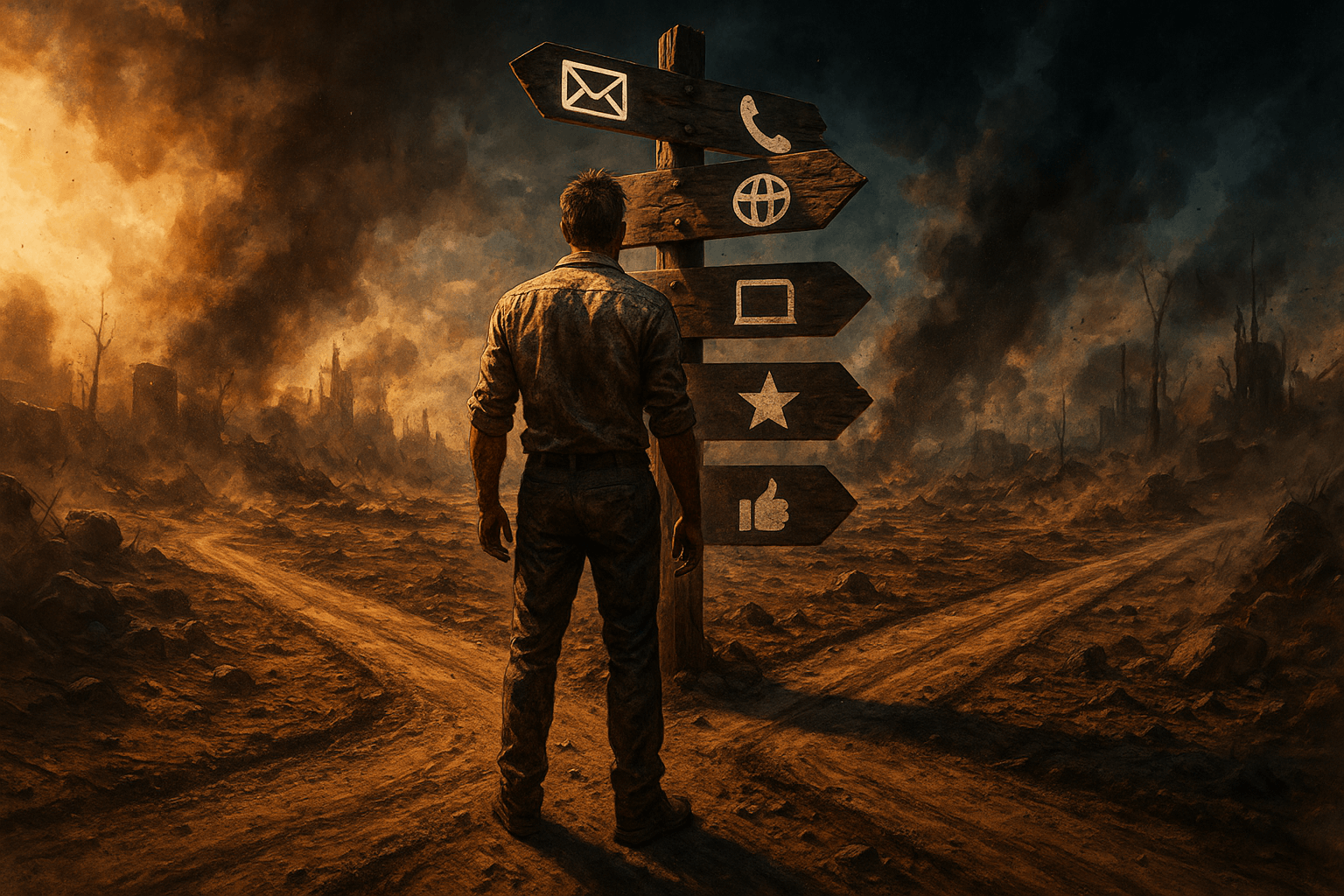

Touchpoints are everywhere: digital ads, quote forms, phone calls, blog posts, referrals. You’re doing good work, but you might be invisible in too many of these interactions. And that’s a problem.

What Counts as a Touchpoint, and Why It’s More Than You Think

Let’s clear something up: touchpoints aren’t just flashy marketing moments. They’re everything. A Google search. A blog post. A quote tool. A phone call. A neighbor’s recommendation. A LinkedIn comment. All of it stacks up.

The problem? Most agents still think “marketing” means posting once on Facebook or running an ad campaign for two weeks and waiting for the phone to ring. But insurance buyers, especially the ones you actually want, don’t work that way anymore.

They’ve got insurance ADHD. They’re checking reviews on Yelp after scrolling Zillow. They see your billboard at the varsity football game one day and forget you exist the next. Every time they see your name, read your words, or interact with your info? That’s a touchpoint. And it adds up fast.

Research shows the average insurance buyer goes through over 30 touchpoints before making a purchase. Even something as simple as a homeowners policy involves eight to twelve meaningful interactions. That means if you’re only showing up in one or two of those, you’re barely in the game.

And here’s the kicker: not all touchpoints are created equal. A slick homepage visit doesn’t carry the same weight as a three-minute blog post that actually answers their question. A one-and-done Facebook ad isn’t as sticky as a follow-up email from someone they trust. It’s not just about getting in front of people, it’s about getting in front of them with something that matters.

Action Item:

Open a blank document. List every way someone might “meet” your agency: Google results, blog posts, client referrals, emails, social media, your GMB profile, your voicemail greeting, local advertising, chamber events. If you don’t hit at least 10, you’ve got a visibility gap. That’s your starting line.

The Multi-Channel Shuffle: Why Visibility Has to Be Spread Out

If you think your website is doing the heavy lifting alone, think again. Most insurance prospects aren’t walking a straight line from Google to your quote form. They’re zigzagging across half a dozen platforms, comparing, bouncing, asking around, second-guessing, and every twist in that path is another one of those critical touchpoints.

Here’s the blunt truth: your next customer might check out your agency five times before they even realize they’ve heard of you.

- They read a Google review.

- They click a blog post.

- They scroll past a Facebook ad.

- They hear your name from a friend.

- They see your logo on a baseball field banner.

By the time they call you, they’ve had 10 or more interactions, many you never even saw. That’s the reality of omnichannel touchpoints in 2025. And it’s not just tech-savvy millennials. Everyone from first-time homeowners to trucking company owners is jumping between screens, tabs, and conversations.

Here’s the hot take: It’s not about being everywhere. It’s about being somewhere consistently. If your agency shows up with actual value in just three or four channels, email, search, a blog, maybe YouTube, you’ll show up more often and more meaningfully than most of your competitors chasing every shiny platform.

The data backs it up. Google says most buyers use at least three different channels before taking action. McKinsey found insurance buyers contact their agent about four times before they buy. That’s not counting the quote tools, content reads, or social proof touches happening behind the scenes.

So stop thinking like a billboard. Start thinking like a trail of breadcrumbs.

Action Item:

Pick your top three marketing channels. Ask: Are we posting there consistently? Are we helpful or just promotional? Then look at your last month, how many touchpoints did those channels create? If you don’t know, start tracking. Awareness without follow-up is just noise.

High Stakes, High Touch: Why Insurance Requires More Touchpoints Than Most Industries

You’re not selling sneakers. You’re selling peace of mind, protection, and in some cases, a $100,000 promise. So let’s stop comparing insurance marketing to e-commerce. This isn’t a click-to-buy game. It’s a trust game, and trust takes more touchpoints.

A 2025 industry report shows the average customer journey includes 32.9 touchpoints before an insurance sale. That’s higher than almost any other category. Why? Because insurance buyers, especially business owners, are making serious, often uncomfortable decisions. And they want reassurance at every turn.

Let’s break it down:

- Homeowners insurance? 8–12 touchpoints. People read blogs, compare quotes, check reviews, then finally call someone.

- Workers’ comp? 15–25 touchpoints. HR, finance, and maybe a co-owner all get involved. Each adds more questions, more calls, more emails.

- Trucking insurance? Easily 30+ touchpoints. High premiums, strict underwriting, and a maze of compliance details make it a grind.

- Commercial auto? Anywhere from 10 to 20, depending on how many vehicles, decision-makers, or questions they’ve got.

Here’s the big takeaway: The more valuable or complicated the policy, the more touchpoints it takes to close.

If your agency is set up like it’s 2012, one call to close, one-page website, set-it-and-forget-it marketing, you’re missing 90% of the real journey. Customers are building trust long before they ever talk to you. And if you’re not part of those early steps, you’re not even being considered.

Action Item:

Pick one product line you want more of, homeowners, workers’ comp, whatever. Write down what you wish your ideal client would know before they call you. That list? That’s your next five pieces of content. That’s how you start showing up in more touchpoints without sounding like a sales robot.

The Real Problem: Most Agents Only Show Up in 2–3 Touchpoints

Here’s the part nobody wants to admit: most independent agents are showing up in just two or three touchpoints before a prospect makes a decision. That’s not a guess, that’s what happens when you rely on referrals, a website you haven’t updated since 2019, and maybe a Google Business profile with five reviews.

Meanwhile, your future client is having a 30-step conversation…and you’re missing 90% of it.

They’re not just comparing prices, they’re deciding who they trust. And every time your competitor shows up with a quote tool, an educational article, or a five-star review, that’s one more vote in their favor. You’re not losing business because your coverage is wrong. You’re losing it because you’re invisible.

Here’s a quick comparison:

The 2-Touchpoint Agency:

- A friend refers them.

- They visit your homepage.

(That’s it. Now they’re off Googling someone else.)

The 20-Touchpoint Presence:

- They saw your blog when researching deductibles.

- Found your name again while checking rates.

- Watched a short video explaining workers’ comp.

- Read a case study from a local business owner.

- Got an email answering a question they Googled last week.

- THEN they called.

Which agency feels more trustworthy? More helpful? More like a safe bet?

Exactly.

And no, you don’t need to be loud, flashy, or glued to your phone. You just need to show up with some consistency. One solid piece of content per week builds a trail that prospects can follow. That’s how you stop being an option and start being the obvious choice.

Action Item:

Audit your last 10 new clients. Ask them honestly: “Where did you first hear about us? What did you look at before you called?” Write it down. Then count how many touchpoints you were actually part of. If the number is under five, you’ve got work to do, but now you know where to start.

Quiet Wins Come From Showing Up More Than Once

If there’s one thing to take away, it’s this: people don’t buy after one click. They buy after trust. And trust takes repetition. Whether you’re writing a blog, answering a question in an email, or showing up on Google when they’re finally ready to switch, those are all touchpoints. And they all count.

Most agents aren’t losing because they’re bad at what they do. They’re losing because they’re missing from too many of the moments that matter. If you want steady, reliable growth, the kind that feels calm instead of chaotic, you don’t need more content. You need the right content, delivered steadily, so you show up early and often.

That’s exactly what we build inside Agency Content Engine – Your Done For You Content Marketing Engine. No more blank pages. No more “we should really post something.” Just consistent, smart, respectful marketing that multiplies your visibility while you stay focused on running your agency.

Quiet growth isn’t a myth. It just takes showing up. Not once. But often.